A:

Tools of Financial Analysis

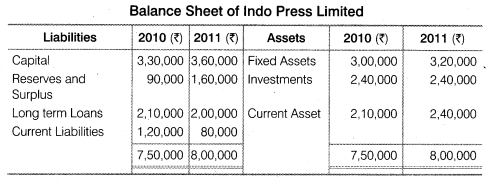

1. Comparative Statements: Such statements are the statements showing the

profitability and financial position of a firm for different periods of time in a comparative form to get an idea about the position of the firm in two or more

periods. Firms and companies apply this with regard to only 2 financial statements viz. Balance Sheet and Income Statement. Hence, they prepare these 2 financial statements in the comparative form. Noteworthy, the firms need to use the same accounting principles to get a better result.

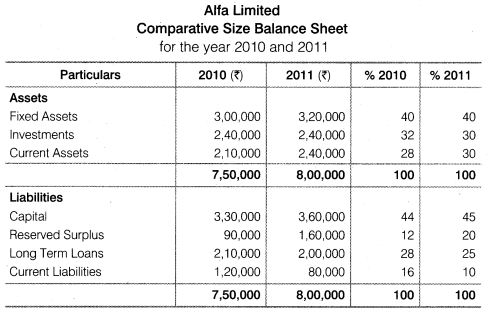

2. Common Size Statement: These are the statements which indicate the

relationship of different items of a financial statement with some common item

by showing each item as a percentage of the common item. It enables the firms to do the inter-firm as well as an intra-firm comparison which is almost impossible in case of comparative statements. Hence, it is also known as ‘Vertical analysis‘. Its purpose is to study the key changes and trends in the financial position.

3. Trend Analysis: It is a technique of studying the operational results and financial position over a series of years. Using the previous years’ data, a business enterprise does trend analysis to observe the percentage changes over time for the selected data. Trend analysis is important for the business because it points at the basic changes in the nature of the business. By looking at a trend in the particular ratio, firms may find whether the ratio is falling, rising or remaining constant. After due observation, relevant steps can be taken.

4. Ratio Analysis: Ratio analysis is a process of analyzing and reviewing the

company’s financial statement and performance. It is a quantitative analysis in

which many factors of company financial performance is evaluated. Like solvency ratios, debt management ratios, liquidity, market value ratio, asset management ratio, profitability, etc. As a technique of financial analysis, accounting ratios measure the comparative importance of the individual items of the income and position statements. Hence, it helps to assess the profitability, solvency, and efficiency of an enterprise.

5. Cash Flow Analysis: It refers to the analysis of the actual movement of cash int and out of the organization. The flow of cash into the business is called as cash inflow and the flow of cash out of the firm is called as cash outflow or negative cash flow.

Hence, by preparing the cash flow statement, the firm is able to find out the various reason behind the inflow and outflow of the cash.

Limitations of Financial Analysis: Although there are many advantages of the financial statements, there are certain disadvantages of the same. As the analysis is done on the basis of data provided in the financial statements which can be incorrect. Hence, it is necessary for the firms to consider in mind various limitations as well.

1. While doing the financial analysis, firms often fail to consider the price changes. When firms compare data from various time periods, they do it without providing the index to the figures. Hence, the firm does not show the inflation impact.

2. Intangible assets not recorded. Firms do not record many intangible assets. Instead, any expenditure made to create an intangible asset are immediately

charged to expense.

3. Firms consider only the monetary aspects of the financial statements. They do

not consider the non-monetary aspect.

4. Firms prepare the financial statements on the basis of on-going concept, as

such, it does not reflect the current position.

5. The statements do not necessarily provide any value in predicting what will

happen in the future.